Of The Four Graphs To The Left, Which Best Approximates The Shape Of The Money Demand Curve?

Affiliate 11. Monopoly and Antitrust Policy

11.iii Regulating Natural Monopolies

Learning Objectives

By the end of this section, you will be able to:

- Evaluate the appropriate competition policy for a natural monopoly

- Interpret a graph of regulatory choices

- Contrast cost-plus and toll cap regulation

Nearly truthful monopolies today in the U.S. are regulated, natural monopolies. A natural monopoly poses a hard challenge for contest policy, because the construction of costs and demand seems to make competition unlikely or costly. A natural monopoly arises when average costs are declining over the range of product that satisfies market demand. This typically happens when stock-still costs are large relative to variable costs. As a result, i house is able to supply the total quantity demanded in the marketplace at lower cost than two or more firms—so splitting upwardly the natural monopoly would raise the boilerplate price of product and strength customers to pay more.

Public utilities, the companies that have traditionally provided h2o and electrical service across much of the U.s., are leading examples of natural monopoly. Information technology would make little sense to argue that a local water company should be cleaved up into several competing companies, each with its ain split up set of pipes and water supplies. Installing iv or v identical sets of pipes under a urban center, one for each water company, so that each household could cull its own water provider, would be terribly plush. The same argument applies to the idea of having many competing companies for delivering electricity to homes, each with its own set of wires. Before the advent of wireless phones, the argument likewise practical to the idea of many different phone companies, each with its own set of phone wires running through the neighborhood.

The Choices in Regulating a Natural Monopoly

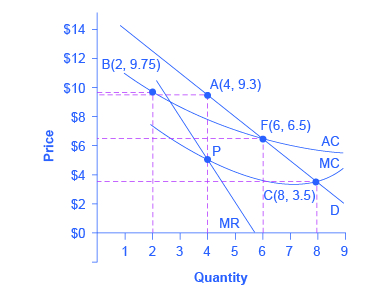

So what then is the appropriate contest policy for a natural monopoly? Effigy 1 illustrates the case of natural monopoly, with a market need curve that cuts through the downward-sloping portion of the average cost curve. Points A, B, C, and F illustrate four of the main choices for regulation. Table five outlines the regulatory choices for dealing with a natural monopoly.

| Quantity | Cost | Full Acquirement* | Marginal Acquirement | Total Cost | Marginal Cost | Average Toll |

|---|---|---|---|---|---|---|

| 1 | 14.7 | 14.vii | – | xi.0 | – | eleven.00 |

| two | 12.four | 24.7 | x.0 | 19.5 | viii.5 | 9.75 |

| 3 | 10.6 | 31.7 | 7.0 | 25.5 | half dozen.0 | 8.50 |

| 4 | ix.3 | 37.2 | 5.5 | 31.0 | 5.5 | 7.75 |

| 5 | 8.0 | 40.0 | 2.8 | 35.0 | four.0 | 7.00 |

| 6 | 6.five | 39.0 | –1.0 | 39.0 | four.0 | 6.50 |

| 7 | 5.0 | 35.0 | –4.0 | 42.0 | three.0 | half dozen.00 |

| eight | 3.five | 28.0 | –7.0 | 45.5 | 3.five | 5.70 |

| 9 | 2.0 | xviii.0 | –10.0 | 49.five | four.0 | 5.five |

| Table 5. Regulatory Choices in Dealing with Natural Monopoly. (*Full Acquirement is given by multiplying price and quantity. However, some of the price values in this tabular array have been rounded for ease of presentation.) | ||||||

The first possibility is to leave the natural monopoly solitary. In this instance, the monopoly will follow its normal approach to maximizing profits. It determines the quantity where MR = MC, which happens at point P at a quantity of four. The business firm and so looks to betoken A on the demand bend to detect that it can charge a price of 9.3 for that profit-maximizing quantity. Since the cost is above the average cost curve, the natural monopoly would earn economical profits.

A 2nd event arises if antitrust authorities make up one's mind to divide the company, so that the new firms can compete. As a simple case, imagine that the visitor is cut in half. Thus, instead of one big business firm producing a quantity of 4, two one-half-size firms each produce a quantity of 2. Because of the declining average cost curve (Air conditioning), the boilerplate cost of production for each of the half-size companies each producing 2, as shown at point B, would be 9.75, while the average cost of production for a larger firm producing four would only be vii.75. Thus, the economy would become less productively efficient, since the good is beingness produced at a higher average cost. In a situation with a downwardly-sloping boilerplate cost bend, two smaller firms will e'er have college average costs of production than one larger firm for whatsoever quantity of total output. In addition, the antitrust authorities must worry that splitting the natural monopoly into pieces may be merely the start of their problems. If one of the ii firms grows larger than the other, it volition accept lower average costs and may be able to drive its competitor out of the market. Alternatively, 2 firms in a marketplace may discover subtle ways of coordinating their behavior and keeping prices high. Either style, the result will non be the greater competition that was desired.

A third alternative is that regulators may make up one's mind to gear up prices and quantities produced for this industry. The regulators will effort to choose a point along the market demand curve that benefits both consumers and the broader social interest. Point C illustrates 1 tempting choice: the regulator requires that the firm produce the quantity of output where marginal cost crosses the need curve at an output of 8, and accuse the price of 3.5, which is equal to marginal cost at that point. This rule is appealing because it requires price to be set equal to marginal cost, which is what would occur in a perfectly competitive market, and it would clinch consumers a higher quantity and lower price than at the monopoly option A. In fact, efficient allocation of resources would occur at bespeak C, since the value to the consumers of the last unit of measurement bought and sold in this market is equal to the marginal cost of producing information technology.

Attempting to bring about bespeak C through forcefulness of regulation, withal, runs into a severe difficulty. At betoken C, with an output of 8, a toll of 3.5 is below the average price of production, which is v.7, and so if the firm charges a price of three.five, information technology will be suffering losses. Unless the regulators or the regime offering the firm an ongoing public subsidy (and there are numerous political problems with that option), the firm volition lose money and exit of business.

Perhaps the most plausible pick for the regulator is indicate F; that is, to set the price where AC crosses the need curve at an output of 6 and a price of 6.5. This plan makes some sense at an intuitive level: permit the natural monopoly charge plenty to cover its average costs and earn a normal charge per unit of profit, then that information technology tin can continue operating, but prevent the firm from raising prices and earning abnormally loftier monopoly profits, as it would at the monopoly selection A. Of course, determining this level of output and price with the political pressures, time constraints, and limited information of the real world is much harder than identifying the point on a graph. For more on the problems that can arise from a centrally determined price, see the discussion of price floors and price ceilings in Need and Supply.

Cost-Plus versus Toll Cap Regulation

Indeed, regulators of public utilities for many decades followed the full general approach of attempting to choose a signal similar F in Effigy 1. They calculated the average cost of production for the h2o or electricity companies, added in an amount for the normal rate of profit the firm should expect to earn, and gear up the cost for consumers accordingly. This method was known equally cost-plus regulation.

Toll-plus regulation raises difficulties of its own. If producers are reimbursed for their costs, plus a bit more than, then at a minimum, producers have less reason to be concerned with high costs—considering they tin simply pass them along in college prices. Worse, firms nether cost-plus regulation even accept an incentive to generate high costs by edifice huge factories or employing lots of staff, because what they can accuse is linked to the costs they incur.

Thus, in the 1980s and 1990s, some regulators of public utilities began to use price cap regulation, where the regulator sets a price that the firm can accuse over the next few years. A mutual pattern was to require a price that declined slightly over fourth dimension. If the business firm tin find ways of reducing its costs more than apace than the toll caps, information technology can make a high level of profits. However, if the business firm cannot proceed upwardly with the toll caps or suffers bad luck in the market place, information technology may suffer losses. A few years down the road, the regulators will then set a new series of price caps based on the firm's performance.

Price cap regulation requires delicacy. Information technology volition not work if the price regulators prepare the price cap unrealistically low. It may not work if the market changes dramatically so that the firm is doomed to incurring losses no matter what it does—say, if energy prices rise dramatically on world markets, then the visitor selling natural gas or heating oil to homes may not be able to meet cost caps that seemed reasonable a year or two ago. But if the regulators compare the prices with producers of the aforementioned expert in other areas, they tin, in outcome, pressure a natural monopoly in one area to compete with the prices being charged in other areas. Moreover, the possibility of earning greater profits or experiencing losses—instead of having an average charge per unit of profit locked in every yr past cost-plus regulation—tin can provide the natural monopoly with incentives for efficiency and innovation.

With natural monopoly, marketplace competition is unlikely to take root, so if consumers are not to suffer the high prices and restricted output of an unrestricted monopoly, government regulation volition need to play a role. In attempting to design a system of price cap regulation with flexibility and incentive, government regulators do not have an easy job.

Primal Concepts and Summary

In the example of a natural monopoly, market contest will not work well and so, rather than allowing an unregulated monopoly to enhance toll and reduce output, the government may wish to regulate price and/or output. Common examples of regulation are public utilities, the regulated firms that ofttimes provide electricity and water service.

Cost-plus regulation refers to authorities regulation of a business firm which sets the cost that a firm can accuse over a period of time by looking at the firm's accounting costs and so adding a normal rate of profit. Price cap regulation refers to authorities regulation of a house where the regime sets a price level several years in accelerate. In this instance, the firm can either make loftier profits if it manages to produce at lower costs or sell a college quantity than expected or suffer low profits or losses if costs are loftier or it sells less than expected.

Self-Check Questions

- Urban transit systems, especially those with rail systems, typically feel pregnant economies of scale in operation. Consider the transit organization whose data is given in the Table half-dozen. Note that the quantity is in millions of riders.

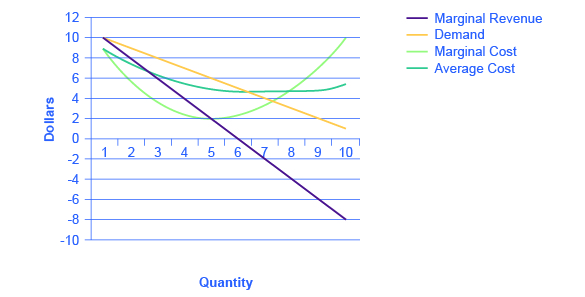

Need: Quantity 1 2 3 4 5 6 seven 8 nine 10 Price 10 ix viii 7 half dozen 5 4 3 two 1 Marginal Revenue 10 8 half-dozen four ii 0 –2 –4 –6 –8 Costs: Marginal Toll nine 6 5 3 two 3 4 5 7 10 Boilerplate Price 9 7.5 half dozen.vii 5.viii 5 4.vii 4.half-dozen 4.6 4.9 5.four Table 6. Describe the demand, marginal revenue, marginal cost, and average price curves. Do they have the normal shapes?

- From the graph you drew to respond Self-Check Question 1, would you say this transit system is a natural monopoly? Justify.

Review Questions

- If public utilities are a natural monopoly, what would be the danger in deregulating them?

- If public utilities are a natural monopoly, what would exist the danger in splitting them upwardly into a number of separate competing firms?

- What is price-plus regulation?

- What is price cap regulation?

Disquisitional Thinking Questions

- In the middle of the twentieth century, major U.S. cities had multiple competing city bus companies. Today, there is ordinarily only i and information technology runs as a subsidized, regulated monopoly. What do you lot suppose caused the change?

- Why are urban areas willing to subsidize urban transit systems? Does the statement for subsidies make sense to you?

Problem

Employ Tabular array six to respond the following questions.

- If the transit organisation was allowed to operate as an unregulated monopoly, what output would it supply and what price would it charge?

- If the transit system was regulated to operate with no subsidy (i.east., at cypher economical profit), what approximate output would it supply and what approximate price would it charge?

- If the transit system was regulated to provide the well-nigh allocatively efficient quantity of output, what output would information technology supply and what cost would information technology charge? What subsidy would be necessary to insure this efficient provision of transit services?

Glossary

- toll-plus regulation

- when regulators permit a regulated firm to embrace its costs and to make a normal level of profit

- price cap regulation

- when the regulator sets a cost that a house cannot exceed over the next few years

Solutions

Answers to Cocky-Check Questions

- Aye, all curves accept normal shapes.

Effigy 2. - Yes information technology is a natural monopoly because average costs decline over the range that satisfies the marketplace demand. For instance, at the indicate where the need curve and the average cost curve meet, at that place are economies of scale.

Source: https://opentextbc.ca/principlesofeconomics/chapter/11-3-regulating-natural-monopolies/

Posted by: mixonkinces69.blogspot.com

0 Response to "Of The Four Graphs To The Left, Which Best Approximates The Shape Of The Money Demand Curve?"

Post a Comment