How To Save Money Earning Minimum Wage

Permit me show you how to save coin on minimum wage – because without these strategies, information technology's going to be well-nigh incommunicable to do.

I'm non going to sit here and pretend it's piece of cake to relieve money when you make minimum wage.

It's non.

Having said that, I can tell you that information technology's non impossible, either.

How to save money on minimum wage? Well, you've gotta become crafty.

I've got over two decades of feel with helping others – and myself – save money in less-than-stellar circumstances.

Then, buckle up as I go through my best tactics for yous!

Simply first up, let's address the elephant in the room.

Can You Live Off Minimum Wage (Let Alone Save Money)?

Is it even possible to live off of minimum wage (let solitary save money when you're earning minimum wage)?

Yous've probable seen the minimum wage budget example McDonald's put out, and how the internet basically laughed at it.

This was considering of:

- how unrealistic the upkeep was in terms of how much things and bills actually cost

- the assumption that someone working full-time (xl hours/week) at McDonald'southward likewise has time for another job that earns almost every bit much

- in that location's nothing budgeted for childcare, or gasoline (even though there'southward $150 budgeted for a car payment…)

- etc.

Here'due south a link to information technology in case you missed information technology.

I practice similar that McDonald'south included $100 in savings/month in their budget, showing that saving money – even on minimum wage – is extremely important.

However, I feel like they didn't really give any help for how people can do this.

Is information technology possible to live on minimum wage? Yep.

Is information technology darn hard to do (similar, you really accept to have a lot of expert strategies in place, such as living with a roommate who pays half of the bills)? Yes.

Since this is an article on how to save coin on minimum wage, I'chiliad going to dive into that. But rest bodacious that following these strategies beneath volition also help you to live off of minimum wage.

Considering if yous can't salve money, and so you never end the paycheck-to-paycheck cycle.

How to Save Money on Minimum Wage

Living paycheck to paycheck feels lousy. Amiright?

That's why I'm dedicating this commodity to my best tips on how to salve money when you're making a depression income.

1. Apply for a Savings Match Program

Have you ever heard of savings match programs?

These are government, bank, and non-turn a profit-sponsored programs that match your savings. Which ways, y'all can set aside but a fiddling money and really get-go to build an emergency fund and other savings.

You can click through to my article on the subject for lots more info, and here's a rundown of the type of programs you'll notice:

- Nonprofit and Government Matched Savings Accounts

- Banking company/Organization Matched Savings

- IRS Tax Incentives for Retirement Savings

- Employer Matched Savings

2. Get Cash Incentives from Your Wellness Insurance Wellness Program

Finding several hundred dollars you tin put into savings this year could be as simple as looking at your employer health insurance plan.

Have you lot ever heard of an insurance wellness program?

These are incentive-based programs to get you to take healthy actions throughout the twelvemonth. Insurance companies are willing to pay you to do this because overall, it lowers their costs as a visitor.

I was pleasantly surprised to notice out that on my husband's terminal employer, we could EACH earn $450/year past recording our weekly exercise, going for the gratuitous annual physicals nosotros already did (just needed to have the doctor's part fill out one course), and other easy actions.

And guess we? We pocketed that $900 at the end of the year, in the course of a check from the health insurance company.

SCORE.

We're on a unlike insurance programme now with a different employer…and they offer a $250 incentive per person, that yous can apply towards healthcare costs. Woohoo!

Enquire your employer, talk to Hr, or log into your health insurance programme online to see if yours offers something similar.

Some programs may offer a discount on your health insurance premiums (that y'all would then have that money and put into your savings), while others give cold, hard, cash.

3. Use Your GI Bill College Benefits

How to save coin with depression paying task?

Well, if you have GI Nib benefits with college help (like the mail-nine/11 GI Bill), then definitely wait into getting that degree.

That'southward because not just will that help you to somewhen get the skills to become out of a minimum wage job, but you lot too volition likely qualify for a housing stipend.

When my married man used his GI bill to go dorsum to higher and go his caste several years ago, we were pleasantly surprised with a sizable monthly housing stipend that came with it (over $1,000/month).

4. Scan Receipts for Greenbacks and Gift Cards

Do you grocery shop? Thought then – nigh everyone I know has to buy nutrient.

You lot're going to use those receipts from the grocery store, and any other receipts yous have throughout the week, and scan them for gratuitous cash and gift cards.

Can't get better than that, right?

I use three different apps (Aye – you tin input the aforementioned receipt into all iii, for way more than earnings than only one!).

Each 1 is the same as far as how to send in receipts – you simply snap a photograph of it. BOOM.

I'll put them in order of how much I earn:

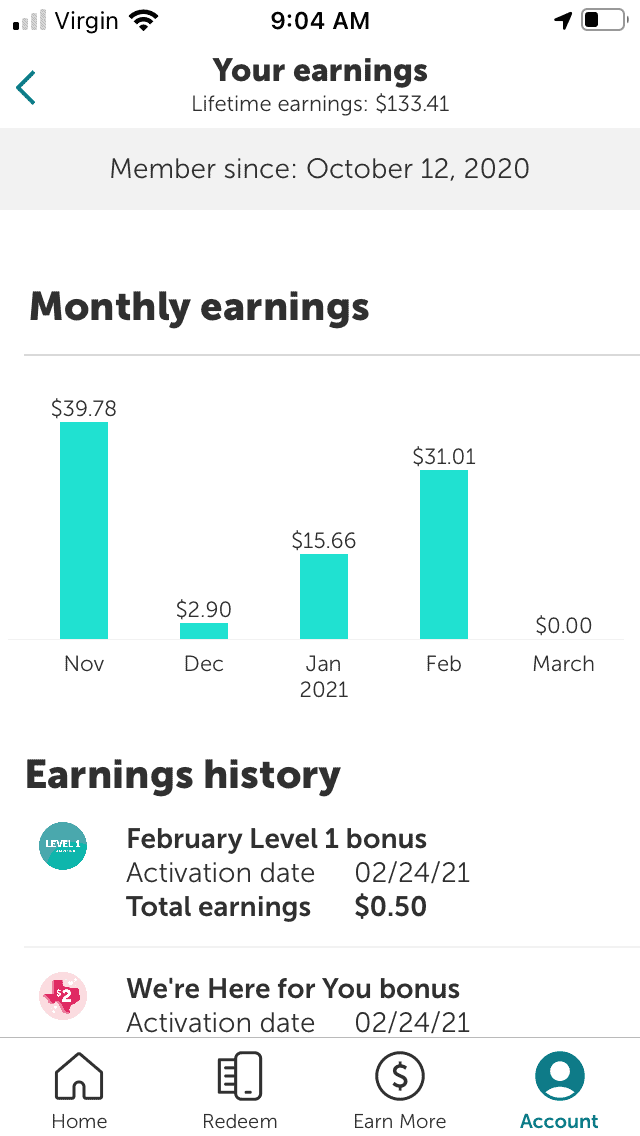

#1: ibotta

Check out how much money I've earned using this app since joining last Oct (4.5 months ago) — $133.41!!

(psst: none of this money earned is from referring others – this is actual earnings from using the app itself).

With this app, you lot become through the offers and choose which you're going to buy anyway. Then y'all add those offers to your business relationship, and at the end of your grocery shopping trip, y'all scan in the receipt to collect.

I just dear how many bonuses they have!

What I love about this app is that you can cash out in ACTUAL cash. So, I can withdraw that money anytime I'd like to my PayPal account or directly to a banking concern business relationship. You lot as well have the option to greenbacks out via a gift card.

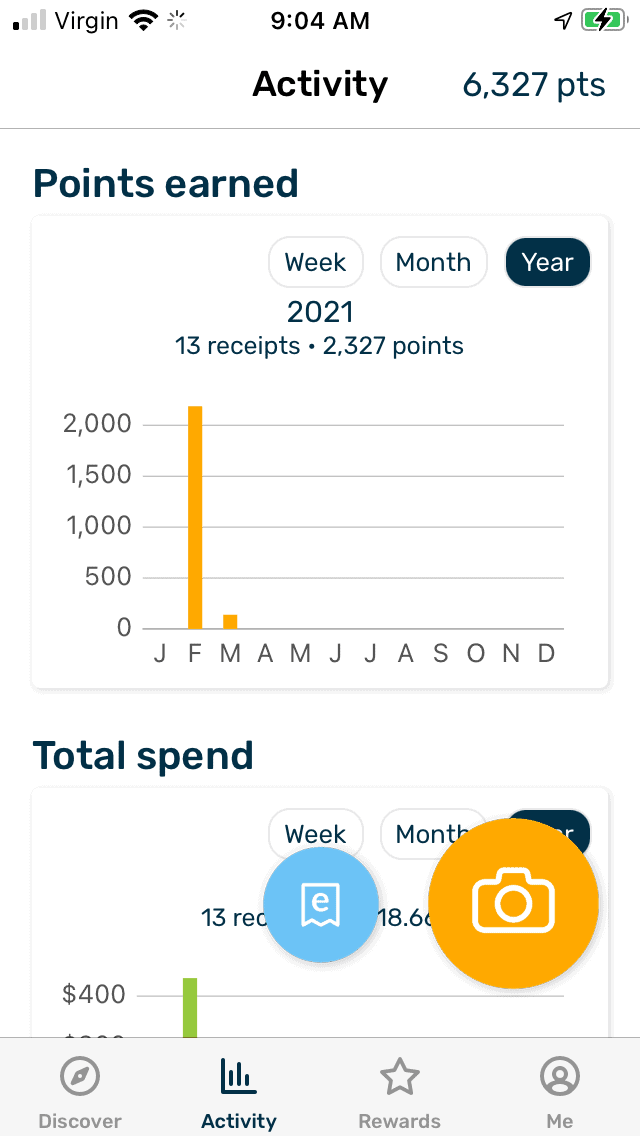

#ii: Fetch Rewards

I just joined these guys last month, and so far, have accrued enough for a $5 gift card to Amazon!

What I like about this app is you lot tin use any receipt to earn points (apps like ibotta only let earnings from specific stores).

While you have to cash out in this app with gift cards, there is an option for a MasterCard/Visa 1 (so y'all would take that gift card and spend it on something you're ownership anyway, like groceries, then take the money you would have spent on groceries and put it into your savings).

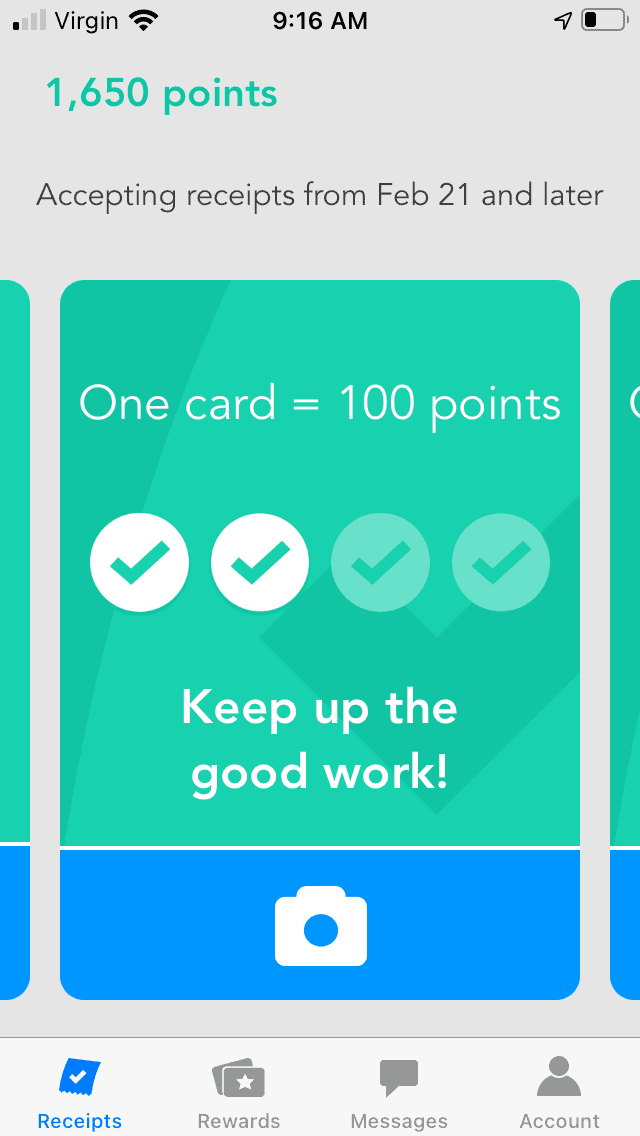

#3: ReceiptPal

This 1 is super simple, but too earns the least.

You but snap a photo of your receipt from any location, and each carte of receipts you lot fill up up, y'all earn 100 points.

5. Find Out if You Qualify for Depression-Income Programs

I've got a huge commodity on both national and local financial emergency resources, and you'll definitely want to take a look as some of the programs are not for emergencies, but to assist low-income families and individuals.

vi. Carve up the Majority of Your Expenses

Working for minimum wage means information technology volition be about impossible for you to live on your own, permit solitary live on your own AND save money.

You've gotta go creative with splitting expenses with others.

For case, my aunt lived in Washington D.C. in a posh neighborhood for most of her adult life. She did this past renting out iii-v rooms in the house. As one roommate moved out, she'd interview and supercede them with some other. She's met some amazing people over the years this fashion!

Other creative examples of people who carve up expenses:

- Own a car? Commute with someone else and have them give you lot $10, $20, or whatever amount each calendar week for gas that makes upwards their share.

- Textbook share for a course with someone else. I went to the London Schoolhouse of Economics for a semester, and it'due south completely normal for professors to order ane or ii copies of all textbooks for the class, house the in the library, and take everyone share the same textbooks. It can be done with just 2 people!

- View your "eating out" budget equally simply when the boss pays – meaning, you become to eat out when your travel for work and you get reimbursed.

- Divide a Bulk-Buy store membership (and finds) with someone else (like Costco or Sam's Club).

- Go rid of amusement costs (simply don't go bored) with these 74 things to do with friends without spending money, and 19 free printable board games for adults

seven. Don't Ain a Car

In most cases, sharing a ride or co-commuting with someone else, or buying a omnibus pass/metro laissez passer, is going to exist way less expensive than owning a car.

When you own a automobile (even a beater auto), it's non just the automobile payment you need to make each month. You'll also demand:

- Weekly/bi-weekly gas money

- Insurance money

- Repair coin

- Oil change money (every few months)

- Registration/emissions inspection money (annual)

Information technology's but not typically worth information technology if you make such niggling income to begin with.

Hint: squeamish about giving up your car? Okay…proceed it, but earn money off of it past sharing it with others.

viii. Brand Amend Use of Your Complimentary Preventative Care Appointments

There's a fine line here, simply to avert actress trips and co-pays to your doctor'southward office, try to brand better apply of your gratis preventative intendance appointments everyone (who has wellness insurance) gets throughout the year.

For example, I've:

- Scheduled a free wellness visit around the time that I had some other health issue I wanted to ask about

- Discussed specific questions nigh my gums with my dentist during routine cleanings, instead of coming back for that issue

- Discussed several questions and issues with my md during my complimentary annual physical when they asked if I had any concerns instead of having to pay for another appointment co-pay

PSA: Whatever you do, don't skimp on doc appointments when you accept symptoms and think something could be wrong – not only could that cost you lots more down the road, just information technology could cost your health and even your life. None of that is worth information technology simply to save money!

9. Buy Unexpired, Salvaged Groceries

When I was a teen, my stepmother plant this outlet grocery shop we used to go to where nosotros routinely scored awesome deals on food that didn't await as pretty every bit it needed to for a regular grocery store.

What a great way to save money on unexpired food!

Get familiar with the discount and salvage grocery stores in your surface area to score some sweet deals. It'll aid you come in under the average household grocery bill for families of 2, 4, etc.

10. Get a Thrill from Austerity Stores (I do!)

Would it exist weird to tell you that I source probably fifty% of my clothes from the thrift store?

It'south a habit I got into when I was in my early 20s, and one I nevertheless haven't changed in my belatedly 30s because you know what?

I enjoy the hunt of a swell deal.

In fact, 1 of my best friends loves to do this, likewise!

You lot will never know how many cool outfits y'all can put together from the thrift shop if you don't try it. And, dare I say, attempt to relish information technology!

Pssst: you'll definitely desire to become this free printable outfit styling guide to figure out how to style your own clothes better, and finds from the thrift store.

eleven. Source All of Your Amusement from the Library

I'm being serious here. If y'all're struggling to save coin, then you don't have funds to pay for amusement, anyhow.

Only you have to enjoy your life, right? Otherwise, what's it really for?

At your local library, yous'll find things like:

- Free DVDs to checkout

- Gratis classes to take

- Free volume talks

- Gratis books and magazines to check out

- Free eBooks to fill your free Kindle app with

- Free children's programs and activities

- Gratis teen programs and activities

- After school activities and programs

- Etc.

And if you live almost a higher? Ask if yous tin get a free membership to their college library – we used to offer this to the "townies" at the college library where I worked (yup – I worked for minimum wage at a library for iv years during college! Information technology was a slap-up job).

I've given y'all my best 11 tips for how to save money on minimum wage. Non all of them are going to piece of work for your state of affairs – then you've gotta pick the ones y'all're willing to try and see what happens. Don't forget to come up back, and option new ones to make even bigger cuts in your expenses, then that you lot can finally get some money over into savings. And one last piece of advice? Don't forget to actually send money from your checking account to your savings business relationship…because that'southward the whole point of going through these tips and implementing them.

The following two tabs change content below.

- Bio

- Latest Posts

Amanda 50. Grossman is a Certified Financial Didactics Instructor, Plutus Foundation Grant Recipient, and founder of Frugal Confessions. Over the terminal 10 years, her money piece of work helping people with how to save money and how to manage money has been featured in Kiplinger, Washington Post, U.S. News & Globe Study, Business Insider, LifeHacker, Woman's World, Adult female's Twenty-four hours, ABC 13 Houston, Keybank, and more. Read more here.

Source: https://www.frugalconfessions.com/save-me-money/how-to-save-money-on-minimum-wage/

Posted by: mixonkinces69.blogspot.com

0 Response to "How To Save Money Earning Minimum Wage"

Post a Comment