Is There An Advantage To Adding Post Tax Money To 401k 2018

In Commonwealth of australia, superannuation, or simply super, is the term for retirement pension do good funds. Most working Australians deposit deductions from their income (every bit wage or salary) into these funds, and employers make similar regular contributions. Most employees contribute to large funds either industry funds (not-for-profit common funds, managed by boards comprising industry stakeholders), or retail funds (for-profit commercial funds, principally managed by financial institutions). Even so, some working Australians deposit their income deductions into cocky-managed superannuation funds.[one]

Superannuation is compulsory for all people working and residing in Australia who earn more than than AU$450 per month. The residuum of a person'due south superannuation account—or for many people, accounts—is then used to provide an income stream upon retirement. Federal constabulary dictates minimum amounts that employers must contribute to the super accounts of their employees, on top of standard wages or salaries.

The Australian Authorities outlines a fix percentage of employee income that should be paid into a super account. Since July 2002, this rate has increased from ix% to 10% in July 2021, and will stop increasing at 12% in July 2025. Employees are too encouraged to supplement compulsory superannuation contributions with voluntary contributions, including diverting their wages or salary income into superannuation contributions under so-called salary sacrifice arrangements.

An avoidable effect with Australia's superannuation organisation is employees failing to consolidate multiple accounts, thus being charged multiple account fees. Of Commonwealth of australia'south 15 meg superannuation fund members, 40% have multiple accounts, which collectively costs them $ii.6 billion in additional fees each year. The federal budget estimates put the number of unnecessary indistinguishable accounts at 10 million. Plans are in place to facilitate consolidation of these accounts.[two] An individual can withdraw funds out of a superannuation fund when the person meets one of the weather condition of release, such as retirement, final medical condition, or permanent incapacity, independent in Schedule ane of the Superannuation Industry (Supervision) Regulations 1994.[3] As of 1 July 2018, members have also been able to withdraw voluntary contributions made as role of the First Domicile Super Saver Scheme (FHSS).[4]

Every bit of 30 March 2022[update], Australians have AU$3.5 trillion invested as superannuation assets, making Australia the 4th largest holder of pension fund assets in the world.[five]

Introduction [edit]

For many years until 1976, what superannuation arrangements were in place were prepare under industrial awards negotiated by the spousal relationship movement or individual unions.

A change to superannuation arrangements came almost in 1983 through an agreement between the authorities and the trade unions. In the Prices and Incomes Accord, the trade unions agreed to forgo a national 3% pay increment which would be put into the new superannuation arrangement for all employees in Australia. This was matched past employers' contributions[ when? ]. Employers' and employees' contributions were originally[ when? ] gear up at 3% of the employees' income, and has been gradually increased.[6] Though there is general widespread support for compulsory superannuation today,[ failed verification ] at the time of its introduction it was met with stiff resistance by small business concern groups who were fearful of the brunt associated with its implementation and its ongoing costs.[7]

In 1992, under the Keating Labor Regime, the compulsory employer contribution scheme became a part of a wider reform package addressing Commonwealth of australia's retirement income dilemma. It had been demonstrated that Australia, along with many other Western nations, would feel a major demographic shift in the coming decades, of the aging of the population, and it was claimed that this would result in increased historic period pension payments that would place an unaffordable strain on the Australian economy. The proposed solution was a "three pillars" arroyo to retirement income:[8]

- compulsory employer contributions to superannuation funds,

- further contributions to superannuation funds and other investments, and

- if insufficient, a safety net consisting of a ways-tested government-funded age alimony.

The compulsory employer contributions were branded "Superannuation Guarantee" (SG) contributions.[9] [10]

The Keating Labor Government had also intended for there to exist a compulsory employee contribution beginning in 1997-98, with employee contributions outset at 1%, then ascension to ii% in 1998-99 and reaching 3% in 1999-2000.[11] Yet this planned compulsory 3% employee contribution was cancelled by the Howard Liberal Government when it took office in 1996.[12] The employer SG contribution was allowed to continue to rise to 9%, which it did in 2002-03. The Howard Regime too express employer SG contributions from ane July 2002 to an employee's ordinary time earnings (OTE), which includes wages and salaries, besides as bonuses, commissions, shift loading and casual loadings, but does not include overtime paid.

The SG rate was 9% from 2002-03 to 2013-14 when the Rudd-Gillard Labor Regime passed legislation[ when? ] to increment SG contributions slowly to 12% starting on 1 July 2015 and ending on 1 July 2019. However, the succeeding Abbott Liberal Government deferred[ when? ] starting this planned increase by half-dozen years, to ane July 2021.[12] The SG charge per unit has been 9.5% of employee earnings since 1 July 2014, and after 30 June 2021 the rate is planned to increment by 0.v% each twelvemonth until it reaches 12% in 2025.[13] [fourteen]

Initially superannuation accounts were considered a employer matter merely over time have evolved considerably. Superannaution is largely portable through a system of preservation until a condition of release occurs (typically retirement) but a superannuation account maintains benefits while retired such equally concessional tax on earnings. A member may motility from fund to fund and tin can consolidate accounts. The October 2020 budget included a proposal (to become law) to mandate portability to encourage and back up each Australian belongings 1 account, which would remain portable. Further proposals are to mandate underperforming funds to be barred from accepting new members. The intention is to encourage functioning to benchmarks for returns and fees.

Operation [edit]

Employer contributions [edit]

Superannuation guarantee contributions [edit]

Under Australian federal law, employers are required to pay superannuation contributions to canonical superannuation funds. Called the "superannuation guarantee" (SG), the contribution pct every bit of July 2021 is ten per cent of the employees' ordinary fourth dimension earnings, which generally consists of salaries/wages, commissions, allowances, but not overtime.[15] SG is only mandated for employees that more often than not make more than $450 in a month, or when working more than thirty hours a week for minors and domestic workers. The main exception is under the NDIS where an individual manages their own insurance plan, and therefore hires their ain carers. SG is not required for non-Australians working for an Australian business organisation overseas, for some foreign executives, for members of the Australian Defence Force working in that role, or for employees covered under bilateral super agreements.[16]

SG contributions are paid on top of an employees pay packet, meaning that they practise not form part of wage or salaries. Contributions must be paid at least one time every quarter, and can but exist paid into approved superannuation funds registered with the Australian Securities and Investments Commission.

Initially, between 1993-1996, a higher contribution charge per unit applied for employers whose annual national payroll for the base year exceeded $1 million, with the employer'southward minimum superannuation contribution percentage set up out in the adjacent tabular array with an asterisk. The contribution charge per unit increased over time. The SG rate was 9.5% on 1 July 2014, and was supposed to increment to 10% on one July 2018; then increase past 0.v% each year until it reached 12% on 1 July 2022. The 2014 federal upkeep deferred the proposed 2018 SG rate increases past 3 years, with the 9.5% rate remaining until 30 June 2021, and is gear up to have five annual increases, where the SG rate will increase to 12% by July 2025. Nonetheless, there accept been lobbying that suggests that the SG charge per unit should remain at the current rate of ix.5% or make superannuation voluntary.[17] [18]

| Effective date (from 1 July) | All Australian internal states and territories[a] | Norfolk Island transitional rate |

|---|---|---|

| 2002 | 9% | 0% |

| 2013 | 9.25% | |

| 2014 | 9.5% | |

| 2015 | ||

| 2016 | 1% | |

| 2017 | 2% | |

| 2018 | 3% | |

| 2019 | 4% | |

| 2020 | v% | |

| 2021 | 10% | vi% |

| 2022 | 10.5% | 7% |

| 2023 | 11% | 8% |

| 2024 | 11.5% | 9% |

| 2025 | 12% | ten% |

| 2026 | 11% | |

| 2027 | 12% |

"Divers do good" superannuation schemes [edit]

Special rules apply in relation to employers operating "defined benefit" superannuation schemes, which are less common traditional employer funds where benefits are determined by a formula commonly based on an employee's final average salary and length of service. Substantially, instead of minimum contributions, employers need to make contributions to provide a minimum level of do good.

Bacon sacrifices contributions [edit]

An employee may asking that their employer makes all or part of future payments of earnings into superannuation in lieu of making payment to the employee. Such an system is known as "salary sacrifice", and for income tax purposes the payments are treated as employer superannuation contributions, which are mostly tax deductible to the employer, and are not discipline to the superannuation guarantee (SG) rules. The arrangement offers a benefit to the employee because the amount so sacrificed does not form part of the taxable income of the employee.

For some purposes, however, such contributions are called "reportable superannuation contributions",[20] and for those purposes they are counted back as a do good of the employee, such as for calculation of "income for Medicare levy surcharge purposes".

To be valid, a salary sacrifice arrangement must exist agreed between employer and employee earlier the work is performed. This agreement is unremarkably documented in writing in pro forma form.

Personal contributions [edit]

People can make boosted voluntary contributions to their superannuation and receive revenue enhancement benefits for doing so, subject to limits. Since the 2021/22 fiscal year, the concessional contribution cap has been $27,500. This figure is indexed to the Average Weekly Ordinary Times Earnings (AWOTE), but will only increase in increments of $ii,500. Whatever contributions in a higher place the limit are called "excess concessional contributions".[21]

Unused concessional contributions cap space tin be carried forrad from 1 July 2018, if the total superannuation balance is less than $500,000 at the end of 30 June in the previous year. Unused amounts are available for a maximum of five years.

Access to superannuation [edit]

Employer and personal superannuation contributions are income of the superannuation fund and are invested over the period of the employees' working life and the sum of compulsory and voluntary contributions, plus earnings, less taxes and fees are paid to the person when they retire.

As superannuation is money invested for a person's retirement, strict government rules preclude early access to preserved benefits except in very limited and restricted circumstances. These include major dental, and drug and alcohol addiction recovery.[22] In general people can seek early release superannuation for severe financial hardship or on compassionate grounds, such as for medical treatment non bachelor through Medicare.

Mostly, superannuation benefits fall into three categories:

- Preserved benefits;

- Restricted non-preserved benefits; and

- Unrestricted non-preserved benefits.

Preserved benefits are benefits that must be retained in a superannuation fund until the employee'southward 'preservation age'. Currently, all workers must wait until they are at least 55 earlier they may access these funds. The actual preservation age varies depending on the date of nascency of the employee. All contributions made afterwards 1 July 1999 fall into this category.

Restricted non-preserved benefits although not preserved, cannot be accessed until an employee meets a status of release, such equally terminating their employment in an employer superannuation scheme.

Unrestricted non-preserved benefits do not crave the fulfilment of a status of release, and may exist accessed upon the request of the worker. For example, where a worker has previously satisfied a condition of release and decided not to access the money in their superannuation fund.

Preservation age and conditions of release [edit]

| Date of birth | Preservation age |

|---|---|

| Before 1 July 1960 | 55 |

| 1 July 1960 – 30 June 1961 | 56 |

| 1 July 1961 – thirty June 1962 | 57 |

| one July 1962 – 30 June 1963 | 58 |

| 1 July 1963 – 30 June 1964 | 59 |

| After xxx June 1964 | 60 |

Do good payments may exist a lump sum or an income stream (pension) or a combination of both, provided the payment is immune under super constabulary and the fund's trust act. Withholding revenue enhancement applies to payments to members who are under 60 or over lx and the do good is from an untaxed source.[23] In either case, eligibility for access to preserved benefits depends on a member's preservation age and meeting one of the atmospheric condition of release.[24] Until 1999, any Australian could access their preserved benefits in one case they reached 55 years of age. In 1997, the Howard Liberal Government changed the preservation rules to induce Australians to stay in the workforce for a longer period of fourth dimension, delaying the effect of population ageing. The new rules progressively increased the preservation age based on a member's date of birth, and came into effect in 1999. The issue is that by 2025 all Australian workers would need to exist at to the lowest degree lx years of historic period to access their superannuation.

To access their super, a fellow member must also meet one of the following "atmospheric condition of release".[25] Before age sixty, workers must exist retired — i.e., cease employment — and sign off that they intend never to work once again (not piece of work more than than twoscore hours in a thirty-day period). Those aged 60 to 65 can access super if they end employment regardless of their future employment intentions, then long every bit they are not working at the time. Members over 65 years of age can admission their super regardless of employment status. Employed individuals who have reached preservation merely are under historic period 65 may admission up to 10% of their super under the Transition to Retirement (TRIS) pension rules.[25]

An Australian worker who has transferred funds from their New Zealand KiwiSaver scheme into their Australian superannuation scheme, cannot access the ex-New Zealand portion of their superannuation until they reach the age of 65, regardless of their preservation age. This rule also applies to New Zealand citizens who have transferred funds from their New Zealand Kiwisaver scheme into an Australian superannuation fund.

Reasonable benefit limits [edit]

Reasonable do good limits (RBL) were applied to limit the amount of retirement and termination of employment benefits that individuals may receive over their lifetime at concessional tax rates.[26] There were 2 types of RBLs - a lump sum RBL and a higher pension RBL. For the financial year ending 30 June 2005, the lump sum RBL was $619,223 and the pension RBL was $1,238,440.[27] RBLs were indexed each year in line with movements in Average Weekly Ordinary Time Earnings published past the Australian Agency of Statistics. The lump sum RBL applied to almost people. Generally, the college pension RBL applied to people who took 50% or more than of their benefits in the class of pensions or annuities that met certain weather condition (for example, restrictions on the ability to convert the pension dorsum into a lump sum).[27] RBLs were abolished from 1 July 2007.[28]

Superannuation taxes [edit]

Contributions [edit]

Contributions fabricated to superannuation, either by an individual or on behalf of an individual, are taxed differently depending on whether that contribution was made from 'pre-tax' or 'post-tax' money. "Pre-tax" contributions are contributions on which no income tax has been paid at time of contribution, and are also known as "earlier-tax" contributions or as "concessional" contributions. They comprise mainly compulsory employer SG ("Superannuation Guarantee", see to a higher place) contributions and additional bacon sacrifice contributions. These contributions are taxed by the superannuation fund at a "contributions tax" rate of 15%, which is regarded as "concessional" rate. For individuals who earn more $250,000, the contributions tax is levied at thirty%.[29]

"Post-taxation" contributions are likewise referred to as "after-tax" contributions, "non-concessional" contributions or equally "undeducted" contributions. These contributions are made from coin on which income revenue enhancement or contributions tax has already been paid, and typically no further tax is required to be withheld from that contribution when it is made to a fund.

Both contribution types are discipline to annual caps. Where the annual cap is exceeded, additional tax is payable, either at the marginal tax charge per unit for concessional contributions, or an additional 31.5% for non-concessional contributions, which is in add-on to the standard tax rate of 15% payable on contributions, making a total of 46.5%.

Over time various measures accept allowed other forms of contribution to encourage saving for retirement. These include pocket-sized business concern CGT contributions and rollovers and Downsizer super contributions [xxx] Each contribution type has specific rules and limits.

Investments in the fund [edit]

Investment earnings of the superannuation fund (i.east. dividends, rental income etc.) are taxed at a apartment rate of 15% by the superannuation fund. In addition, where an investment is sold, capital gains tax is payable past the superannuation fund at 15%.

Much similar the disbelieve available to individuals and other trusts, a superannuation fund can claim a capital gains tax discount where the investment has been endemic for at to the lowest degree 12 months. The discount applicable to superannuation fund is 33%, reducing the effective capital gains taxation from xv% to 10%.[31]

A fund which is paying a pension to a member aged 60+ has exempt alimony income [32] and pays no tax on that portion of the earnings of the fund. Its deductions for that same pct is denied and cannot create a tax loss. An actuarial certificate may be required to support the proportion of exempt pension income based on fellow member balances and numbers of days. Earnings on accumulation (i.eastward., non alimony) balances remain proportionately subject to tax. Asset segregation may exist used by some funds so that specific income is attributed to a specific member. A fund with only pension fellow member accounts which pay the minimum complying pension for the whole year accept a tax charge per unit of 0%.

These taxes contribute over $vi billion in annual government acquirement.[33] Superannuation is a tax-advantaged method of saving every bit the 15% revenue enhancement charge per unit on contributions is lower than the charge per unit an employee would have paid if they received the money as income. The federal government announced in its 2006/07 upkeep that from 1 July 2007, Australians over the age of threescore will face no taxes on withdrawing monies out of their superannuation fund if it is from a taxed source.

Discontinued superannuation surcharge [edit]

In 1996, the federal government imposed a "superannuation surcharge" on higher income earners equally a temporary revenue mensurate. During the 2001 election campaign, the Howard Government proposed to reduce the surcharge from 15% to ten.5% over iii years. The superannuation surcharge was abolished past the Howard Government from i July 2005.

Superannuation co-contribution scheme [edit]

From 1 July 2003, the Howard Liberal Government made bachelor incentives of a Government co-contribution with a maximum value of $ane,000.[34] From the 2012-2013 fiscal year to the 2016-2017 financial year, superannuation contributions are available for individuals with income not in excess of $37,000.[35] The Government offsets a maximum of $500 and a minimum of $20, calculated at 15% of a low income earners total superannuation contributions.[36]

As at 1 July 2017, The Depression Income Superannuation Contribution (LISC) scheme will be replaced with the renamed Low Income Superannuation Revenue enhancement Offset (LISTO).[37] Under this new scheme, the minimum amount of Authorities contributions for low income earners with income not in backlog of $37,000 is lowered to $10 but the $500 maximum remains.[38]

Issue on income tax [edit]

One of the reasons that people contribute to superannuation is to reduce their income tax liability, and perchance to be able to receive an age pension while still receiving supplementary income.

The post-obit is a general summary of the tax rules relating to superannuation. The full details are extremely complex.

Employer superannuation contributions [edit]

Employer superannuation contributions are generally tax deductible if paid to a "complying superannuation fund". This includes compulsory employer contributions also every bit "salary sacrifice" contributions. Employees may choose to make boosted contributions at the same rate as a "salary sacrifice", but only if their employer agrees to practise so.

Taxation of superannuation fund (Contributions) [edit]

Employer contributions received by a superannuation fund and income earned in the fund are taxed at the concessional charge per unit of xv%, or more for higher income earners. Boosted contributions fabricated without the cooperation of an employer or paid to a non-complying superannuation fund are taxed at the acme marginal tax rates and are field of study to different rules.

Revenue enhancement of Superannuation in the US [edit]

Under the U.S.-Commonwealth of australia Income Tax Treaty, at that place is an opportunity to lawfully avoid U.Southward. taxation on gains within Australian Superannuation Funds.[39] [40] [41] Past taking this legal position, Australia would have exclusive taxing rights over Australian Superannuation Funds, which effectively allows Australian nationals residing in the U.S. to lawfully exclude from their U.South federal income tax returns whatsoever gain from their Australian Superannuation Fund or even time to come distributions.[42]

Benefits paid [edit]

Income retrieved from the fund by a member afterwards preservation age is mostly tax free.[i]

Exceeding the concessional contributions cap [edit]

The concessional contribution cap for the 2017-2018 fiscal year is $25,000. For later fiscal years, the cap is worked out by indexing annually this amount. From 1 July 2019 a taxpayer who meets a maximum balance condition who does not use their cap in full may carry forward the unused cap for a limited fourth dimension period. The revenue enhancement laws and rules concerning concessional contributions are complex and not automated entitlement. In the 2021 year a theoretical concessional contribution (tax deductible) of 3 years could be permitted ($75,000) representing unused caps from 2019 and 2002 in addition to the 2021 cap.[43]

Excess concessional contribution (ECC) is included in the assessable income for respective income year, and the taxpayer is entitled to a tax offset for that income year equal to 15% of the backlog concessional contributions (S 291-fifteen of the Income Tax Assessment Act 1997). This offset cannot be refunded, transferred, or carried forward. Excess Contributions Revenue enhancement can be paid past the member past release of funds from the super account.

Backlog concessional contribution accuse [edit]

ECC charge is applied to the additional income tax liability arising due to backlog concessional contributions included in the income tax render- Sectionalization 95 in Schedule 1 to the Revenue enhancement Administration Act 1953. The ECC charge period is calculated from the get-go of the income year in which the excess concessional contributions were fabricated and ends the day earlier the tax is due to be paid under the first income tax cess for that year. The compounding interest formula is applied against the base amount (the boosted income revenue enhancement liability) for each mean solar day of the ECC accuse menses. The ECC charge rates are updated quarterly and for January - March 2019 it is 4.94% per annum.

Concessional contributions and taxable income, exceeding the threshold - Segmentation 293 revenue enhancement [edit]

Division 293 tax (boosted tax on concessional contributions) is payable if income for surcharge purposes (other than reportable super contributions), plus concessionally taxed super contributions (also known as low taxation contributions) are greater than $250,000. Partition 293 tax levies 15% tax on either your total concessional contributions, or the amount (Concessional Contributions + Gross Income) that is over the $250,000 threshold – whichever amount is lower. Div 293 revenue enhancement can be paid by the member by a release from the super fund account.

Non-concessional contributions [edit]

Not-concessional contributions include excess concessional contributions for the financial year. Not-concessional contributions are amounts contributed which a employer or taxpayer has non claimed a tax deduction. They do non include super co-contributions, structured settlements and orders for personal injury or capital letter gains tax (CGT) related payments that the fellow member has validly elected to exclude from their non-concessional contributions. Non-concessional contributions are made into the super fund from later on-tax income. These contributions are not taxed in the super fund. As of 1 July 2021, the non-concessional contributions cap is $110,000 per annum. Members 66 years or younger accept the option of utilizing the 'bring-forrard' dominion which allows an eligible person to contribute 3 years' worth of contributions in the i twelvemonth. If a member's non-concessional contributions exceed the cap, they are taxed at the top marginal revenue enhancement charge per unit. [44]

Effect on Age Pensions [edit]

Australian resident citizens over 67 years of age are entitled to an Age Pension if their income and avails are below specified levels. The full pension, equally at March 2022, is $882.twenty per fortnight for singles, and $665 each for couples. [45] Pension recipients are assessed under an Asset examination and an Income exam and their pension is reduced past whichever examination lowers their pension amount the about. As at March 2022, to be eligible for the full alimony single homeowners must have assets less than $270,500 and single non-homeowners assets less than $487,000. Couple homeowners must have assets less than $405,000 and non-homeowner'south $621,500. [46] The Income exam will utilize to singles who earn more than than $180 per fortnight and couples who earn more than than $320 per fortnight. Pension payments will by reduced by 50 cents for each dollar over these limits. [47]

Superannuation funds [edit]

Trustee structure [edit]

Superannuation funds operate equally trusts with trustees being responsible for the prudential operation of their funds and in formulating and implementing an investment strategy. Some specific duties and obligations are codification in the Superannuation Industry (Supervision) Act 1993 - other obligations are the subject of full general trust law. Trustees are liable under law for breaches of obligations. Superannuation trustees accept, inter alia, an obligation to ensure that superannuation monies are invested prudently with consideration given to diversification and liquidity.[ citation needed ]

Investments [edit]

Other than a few very specific provisions in the Superannuation Manufacture (Supervision) Human action 1993 (largely related to investments in assets related to the employer or impacting a self-managed super fund) funds are non field of study to specific nugget requirements or investment rules. A fund must maintain an investment strategy and comply with specific covenants contained in police at all times.[48] A fund must not lend to a related party and must not acquire investments from a related party unless permitted. There are no minimum rate of return requirements, nor a authorities guarantee of benefits. There are some restrictions on borrowing and the use of derivatives and investments in the shares and property of employer sponsors of funds.

As a result, superannuation funds tend to invest in a broad diversity of assets with a mix of duration and hazard/return characteristics. The contempo investment performance of superannuation funds compares favourably with culling assets such as ten year bonds.[ citation needed ]

Types of superannuation funds [edit]

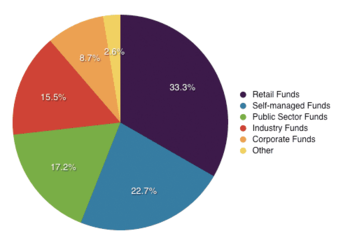

Share of superannuation manufacture fund assets.

There are about 500 superannuation funds operating in Australia. Of those, 362 have assets totalling greater than $fifty million. Superannuation assets totalled $2.7 trillion at the end of the June 2018 quarter, a new tape according to the Clan of Superannuation Funds of Commonwealth of australia.[49]

There are unlike types of superannuation funds:

- Industry Funds are multiemployer funds run by employer associations and/or unions. Unlike Retail/Wholesale funds they are run solely for the benefit of members, as at that place are no shareholders.

- Wholesale Master Trusts are multiemployer funds run by financial institutions for groups of employees. These are as well classified every bit Retail funds by APRA.

- Retail Master Trusts/Wrap platforms are funds run by financial institutions for individuals.

- Employer Funds are funds established by employers for their employees. Each fund has its own trust structure that is not necessarily shared by other employers. APRA has been encouraging employer funds to windup and are less popular in recent years. The price of compliance and maintaining services at a competitive cost is the key driver.

- Public Sector Funds are largely funds establish past Governments. Some are unfunded and the Future Fund was specifically established to set aside savings to meet this future liability.[50] Many merely not all schemes are divers benefit funds which give a life pension rather than a balance that is paid downwardly equally a pension. Newer employees in Public Sector jobs are typically members of an modern accumulation scheme.

- Cocky Managed Superannuation Funds (SMSFs) are funds established under a specific portion of the same laws that govern larger funds. A SMSF allows a small number of individuals (express to 4) and is regulated past the Australian Taxation Office, not APRA. Generally the Trustees (OR Trustee Directors) of the fund are the fund members and the members are all trustees (or Trustee Directors). Where there is a Corporate Trustee, the members are the directors of that company).[51] SMSFs are the well-nigh numerous funds in the Australian super industry, with 99% of the number of funds and 25% of the $two.7 trillion total super assets as of 30 June 2013.[52] SMSFs may be specially structured then that they are an accustomed QROPS fund capable of receiving a transfer of a U.k. pension benefit.

2015 changes to the SIS deed has allowed SMSFs to borrow under limited recourse borrowing rules. Lenders accept adult SMSF loans to enable SMSF's to borrow for residential property, commercial property and industrial property, notwithstanding funds cannot acquire vacant land or modify the nugget eg develop, improve or construct using borrowed coin. There are restrictions placed upon the fund that the trustees of the fund cannot gain a personal advantage from asset acquired past the fund, or purchase from what'southward known as a 'related party'. For case, you would not be able to live in the dwelling that is endemic by your SMSF. SMSF loans are generally bachelor up to lxxx% of the buy price and concenter a high margin to the interest rate in comparing to standard occupier home loans. Major Banks take withdrawn from the SMSF loan market and loans are costly versus traditional loans equally the loan must be a limited recourse loan product that also uses a bare trust to hold the belongings until the loan is repaid.

- SMSF property investment has gained considerable momentum since the subpoena of borrowing provisions to let for the purchase of residential real estate.[53] The ability to obtain a express recourse loan to purchase income-producing property in a favourably low tax environment has influenced a rapidly emerging incidence of direct property investment within SMSF structures in recent times.

- Small APRA Funds (SAFs) are funds established for a small number of individuals (fewer than 5) only unlike SMSFs the Trustee is an Approved Trustee, not the member/due south, and the funds are regulated past APRA. This construction is often used for members who want command of their superannuation investments but are unable or unwilling to see the requirements of Trusteeship of an SMSF.

- Public Sector Employees Funds are funds established by governments for their employees.

Manufacture, Retail and Wholesale Chief Trusts are the largest sectors of the Australian Superannuation Market by internet asset with 217 funds. SMSFs are the largest number of funds with 596,225 funds (2019) representing 32.8% of the $two.7 trillion market [54]

Choice of superannuation funds [edit]

From i July 2005, many Australian employees have been able to cull the fund their employer's future superannuation guarantee contributions are paid into. Employees may change a superannuation fund. They may choose to change funds, for example, because:[55]

- one when their current fund is not bachelor with a new employer,

- consolidate superannuation accounts to cut costs and paperwork,

- a lower-fee and/or better service superannuation fund,

- a ameliorate performing superannuation fund, or

- a fund invests in assets and companies that align with their personal beliefs.

Where an employee has non elected to choose their own fund, employers must since 1 January 2014 make "default contributions" only into an authorised MySuper production, which is designed to exist a uncomplicated, low-cost superannuation fund with few, standardised fees and a single balanced investment option.

Superannuation industry [edit]

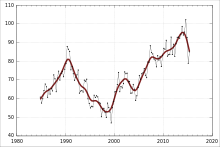

Employment (thousands of persons) in the superannuation industry since 1984

Legislation [edit]

Superannuation funds are principally regulated under the Superannuation Manufacture (Supervision) Human activity 1993 and the Financial Services Reform Human action 2002. Compulsory employer contributions are regulated via the Superannuation Guarantee (Assistants) Act 1992

Superannuation Manufacture (Supervision) Act 1993 (Sis) [edit]

The Superannuation Manufacture (Supervision) Deed sets all the rules that a complying superannuation fund must obey (adherence to these rules is chosen compliance). The rules encompass general areas relating to the trustee, investments, management, fund accounts and administration, enquiries and complaints.

SIS also:[ commendation needed ]

- regulates the performance of superannuation funds; and

- sets penalties for trustees when the rules of operation are non met.

In June 2004 the Sister Act and Regulations were amended to crave all superannuation trustees to utilize to become a Registrable Superannuation Entity Licensee (RSE Licensee) in improver each of the superannuation funds the trustee operates is likewise required to be registered. The transition menstruation is intended to terminate 30 June 2006. The new licensing authorities requires trustees of superannuation funds to demonstrate to APRA that they have acceptable resources (human, technology and financial), gamble management systems and appropriate skills and expertise to manage the superannuation fund. The licensing authorities has lifted the bar for superannuation trustees with a pregnant number of small to medium size superannuation funds exiting the industry due to the increasing take chances and compliance demands.

MySuper [edit]

MySuper is part of the Stronger Super[56] reforms announced in 2011 by the Julia Gillard Government for the Australian superannuation industry. From 1 January 2014, employers must only pay default superannuation contributions to an authorised MySuper product. Superannuation funds have until July 2017 to transfer accrued default balances to MySuper.

A MySuper default is i which complies to a regulated set up of features, including:

- a single investment selection (although lifecycle strategies are permitted),

- a minimum level of insurance cover,

- an easily comparable fee structure, with a short prescribed list of commanded fee types,

- restrictions on how advice is provided and paid for, and

- rules governing fund governance and transparency.[57]

The Fiscal Services Reform Human action 2002 (FSR) [edit]

The Financial Services Reform Act covers a very broad expanse of finance and is designed to provide standardisation within the financial services industry. Under the FSR, to operate a superannuation fund, the trustee must take a licence to run a fund and the individuals within the funds require a licence to perform their job.

With regard to superannuation, FSR:

- provides licensing of 'dealers' (providers of fiscal products and services);

- oversees the training of agents representing dealers;

- sets out the requirements regarding what data must be provided on any financial product to members and prospective members; and

- sets out the requirements that determine adept-conduct and misconduct rules for superannuation funds.

Regulatory bodies [edit]

Four chief regulatory bodies keep watch over superannuation funds to ensure they comply with the legislation:

- The Australian Prudential Regulation Authority (APRA) is responsible for ensuring that superannuation funds acquit in a prudent manner. APRA as well reviews a fund's annual accounts to appraise their compliance with the Sis.

- The Australian Securities and Investments Commission (ASIC) ensures that trustees of superannuation funds comply with their obligations regarding the provision of data to fund members during their membership. ASIC is too responsible for consumer protection in the financial services expanse (including superannuation). It besides monitors funds' compliance with the FSR. MoneySmart is a website run by the Australian Securities and Investments Commission (ASIC) to help people make smart choices about their personal finances. They provide a number of tools such as the Superannuation Figurer.

- The Australian Taxation Part (ATO) ensures that self-managed superannuation funds adhere to the rules and regulations. Information technology also makes sure that the right amount of taxation is taken from the superannuation savings of all Australians.

- The Superannuation Complaints Tribunal (SCT) administers the Superannuation (Resolution of Complaints) Human action. This Act provides the formal procedure for the resolution of complaints. The SCT volition effort to resolve any complaints between a member and the superannuation fund by negotiation or conciliation. The SCT only deals with complaints when no satisfactory resolution has been reached. The SCT ceased handling new complaints from 31 October 2018.

- The Australian Financial Complaints Authority (AFCA) now manages superannuation complaints from Nov 2018. AFCA manages complaints apropos financial products.[58]

Similar schemes in other countries [edit]

- Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TSFA) (Canada)[59]

- Individual Retirement Business relationship (IRA) and 401K (Usa)

- Cocky-Invested Personal Alimony (SIPP) and Stakeholder Pension (United Kingdom)

- Personal Retirement Savings Account (PRSA) - (Ireland)

- KiwiSaver (New Zealand) – Australia and New Zealand have a reciprocal agreement assuasive Australians moving to New Zealand to transfer their KiwiSaver funds to an approved Australian superannuation scheme, and vice versa.[threescore]

- Nippon Private Savings Account (NISA) (Nippon)

- Mandatory Provident Fund (Hong Kong)[61]

- Vanuatu National Provident Fund (Vanuatu) - The Vanuatu National Provident Fund is a compulsory savings scheme for Employees who receive a salary of Vt3, 000 or more a calendar month, to help them financially at retirement.

- Central Provident Fund (Singapore)[62]

- Employees Provident Fund (Malaysia)[63]

- Pensions in Chile

Criticism [edit]

The interaction between superannuation, tax and alimony eligibility is complex, significant that many Australians struggle to engage with their superannuation accounts and utilise them effectively.[64]

The Australian superannuation industry has been criticised for pursuing self-interested re-investment strategies, and some funds accept been accused of choosing investments that benefit related parties ahead of the investor.[ commendation needed ]

Some superannuation providers provide minimal information to account holders nigh how their money has been invested. Usually, but vague categories are provided, such equally "Australian Shares", with no indication of which shares were purchased.[ citation needed ]

Losses to the superannuation funds from the global financial crunch accept as well been a cause for business organization, said to exist around $75 billion.[ attribution needed ] [65]

Run across besides [edit]

- Industry superannuation fund

- Australian Government Future Fund

- German pensions

- Pension organization

- Social Security (Australia)

- Britain pensions

- US pensions

Notes [edit]

- ^ "Internal states and territories" refers to the Australian Capital Territory, New South Wales, Northern Territory, Queensland, Due south Commonwealth of australia, Tasmania. Victoria, and Western Australia.

References [edit]

- ^ "Why cocky-managed super funds are not for anybody". ABC News. Australian Broadcasting Corporation. 10 Apr 2019. Retrieved 11 January 2022.

- ^ The avoidable super fees stinging well-nigh half Australia'southward workforce

- ^ Superannuation Manufacture (Supervision) Regulations 1994 - Schedule 1, Democracy Consolidated Regulations, www.austlii.edu.au, accessed iii Oct 2011.

- ^ Office, Australian Taxation. "First Home Super Saver Scheme". www.ato.gov.au . Retrieved 21 August 2019.

- ^ "Superannuation Statistics". The Association of Superannuation Funds of Commonwealth of australia.

- ^ Main, Andrew (20 Baronial 2011). "Paul Keating vision proves a super saviour". The Australian. News Limited.

- ^ Patrick Collinson (2004) Australia may agree cardinal to pensions, The Guardian, 12 Oct 2004, retrieved 21 July 2006.

- ^ "Chapter 2: Australia's 3-pillar system", Retirement Income Strategic Issues Paper, Australian Government, archived from the original on 28 February 2015

- ^ Cook, Trevor (28 March 2012). "Compulsory super: information technology's good, information technology works and nosotros desire more of information technology". The Conversation. Archived from the original on xiii September 2015.

- ^ "Super guarantee". Australian Taxation Office. 12 May 2017.

The super guarantee requires employers to provide sufficient super back up for their employees. Employers are obliged to contribute a minimum percentage of each eligible employee'due south earnings (ordinary fourth dimension earnings) to a complying super fund or retirement savings account (RSA).

- ^ Dinnison, Ian (Baronial 1995). "Australia adds to corporate burden". International Tax Review.

- ^ a b Keating, Paul (iii September 2014). "This isn't their first superannuation betrayal". Australian Broadcasting Corporation.

- ^ "Super guarantee percentage". Australian Tax Office. 12 May 2017.

- ^ Department 19 of the Superannuation Guarantee (Assistants) Human action 1992

- ^ "How much to pay". Australian Revenue enhancement Office. 6 December 2019. Retrieved 16 November 2020.

- ^ "Working out if you have to pay super". Australian Taxation Office. vii Oct 2019. Retrieved 16 Nov 2020.

- ^ "Superannuation Guarantee charge per unit remains at nine.5% for 2015/2016 year". SuperGuide. 21 June 2015. Retrieved 31 October 2015.

- ^ "The great superannuation debate: raise it, freeze information technology or practice away with it altogether". The Guardian. 23 November 2019. ISSN 0261-3077. Retrieved 12 December 2019.

- ^ "Super guarantee percentage". Australian Taxation Part. 22 September 2020. Retrieved xvi November 2020.

- ^ Role, Australian Tax. "Guide for employees and cocky-employed - reportable superannuation contributions". www.ato.gov.au . Retrieved 4 Apr 2018.

- ^ https://perthfinancialplanning.com.au/superannuation-contribution-caps | Contributions Caps (Limits) into Super

- ^ "Sydney man says Thai rehab clinic saved his life after addiction battle". NewsComAu. 17 November 2019. Retrieved 6 February 2020.

- ^ Function, Australian Revenue enhancement. "Lump sum and income stream (pension)". www.ato.gov.au . Retrieved iv April 2018.

- ^ Role, Australian Revenue enhancement. "Preservation of super". www.ato.gov.au . Retrieved 4 Apr 2018.

- ^ a b Office, Australian Taxation. "Conditions of release". world wide web.ato.gov.au . Retrieved four Apr 2018.

- ^ DIY Funds and Reasonable Benefit Limits past Ross Stephens, KPMG

- ^ a b What are RBLs?, Australian Taxation Role, v June 2007, accessed 3 October 2011

- ^ RBLs were abolished from i July 2007, withal in that location were still RBL obligations for superannuation benefits paid up to thirty June 2007.

Superannuation and reasonable benefit limits, Australian Revenue enhancement Office, four August 2011, accessed 3 October 2011. - ^ "Division 293 tax - information for individuals". ATO . Retrieved 29 April 2016.

- ^ "Downsizing contributions into superannuation | Australian Taxation Office".

- ^ "What is Superannuation?". MoneyGeek . Retrieved vi April 2014.

- ^ "Tax exemptions in the retirement phase | Australian Taxation Office".

- ^ 2006/07 Estimates of Acquirement, 2006-07 Upkeep, Australian Government, 2006, retrieved 21 July 2006

- ^ Superannuation (Government Co-contribution for Depression Income Earners) Deed 2003, section 10.

- ^ Tax Laws Amendment (Stronger, Fairer, Simpler and Other Measures) Act 2012, section 12C(b).

- ^ Revenue enhancement Laws Subpoena (Stronger, Fairer, Simpler and Other Measures) Human action 2012, section 12E.

- ^ Treasury Laws Subpoena (Fair and Sustainable Superannuation) Act.

- ^ Treasury Laws Amendment (Fair and Sustainable Superannuation) Act 2016 section 12E(c).

- ^ "U.S. Tax Treatment of Australian Superannuation Funds". Castro & Co . Retrieved eighteen December 2019.

- ^ Castro, John (5 March 2018). "U.S. Taxation Treatment of Australian Superannuation". Nevada Law Periodical Forum. two (1).

- ^ Cochrane, George (ix November 2019). "Franking credit refund mystery explained". The Sydney Morning Herald . Retrieved 28 February 2020.

- ^ Reilly, Peter J. "Wrong Signature Voids Million-Dollar Plus Refund Merits". Forbes . Retrieved 28 February 2020.

- ^ "Excess concessional contribution charge | Australian Revenue enhancement Part".

- ^ "Contributions Caps (Limits) into Super". Retrieved 10 March 2022.

- ^ https://world wide web.servicesaustralia.gov.au/how-much-age-pension-you-can-get?context=22526 | How much tin you get

- ^ https://www.servicesaustralia.gov.au/avails-test-for-pensions?context=22526 | Avails Test

- ^ https://world wide web.servicesaustralia.gov.au/income-test-for-pensions?context=22526 | Income Examination

- ^ "SUPERANNUATION INDUSTRY (SUPERVISION) Human activity 1993 - SECT 52 Covenants to be included in governing rules--registrable superannuation entities".

- ^ "Quarterly Superannuation Performance". August 2018. Retrieved 22 May 2019.

- ^ "Time to come Fund | Abode".

- ^ What is a SMSF? SMSF Works. Retrieved on 7 November 2013.

- ^ "SMSF statistics: i.ane million members with $822bn in super". xiv November 2021.

- ^ "Guide To SMSF Property Investment". June 2015. Retrieved 30 June 2015.

- ^ https://habitation.kpmg/content/dam/kpmg/au/pdf/2019/super-insights-2019.pdf[ bare URL PDF ]

- ^ "How to add thousands of dollars a year to your super remainder". NewsComAu. 27 August 2019. Retrieved 28 August 2019.

- ^ Federal Government (1 July 2011). "Stronger Super Overview of Reforms". Retrieved 21 February 2013.

- ^ APRA (12 January 2013). "Superannuation reforms 2011-2013". Retrieved 21 February 2013.

- ^ "Australian Motion-picture show Critics Association". Archived from the original on 25 December 2004.

- ^ Bureau, Canada Revenue (xi October 2005). "Registered Retirement Savings Programme (RRSP) - Canada.ca". world wide web.canada.ca . Retrieved 10 Oct 2018.

- ^ "KiwiSaver - KiwiSaver". www.kiwisaver.govt.nz . Retrieved 10 October 2018.

- ^ "MPFA". world wide web.mpfa.org.hk . Retrieved 10 Oct 2018.

- ^ "CPFB Members Habitation". world wide web.cpf.gov.sg . Retrieved 15 October 2018.

- ^ "KWSP - Domicile - KWSP". www.kwsp.gov.my (in Malay). Retrieved 15 October 2018.

- ^ Super for Dummies

- ^ Chief, Andrew (22 October 2011). "Markets forcing retirees to piece of work afterwards $75bn paper loss in superannuation". The Australian. Archived from the original on 22 October 2011. [ content ambiguous ]

External links [edit]

- ASIC's consumer and investor website MoneySmart - Superannuation and Retirement

- Australian Revenue enhancement Function - Superannuation

- Super bailout of $59m - excludes DIY investors

- Government compensates most trio upper-case letter losses

- Business Spectator - Legality and Ramble grounds for Mandatory Superannuation in Australia

- Route Map Release My Super

Source: https://en.wikipedia.org/wiki/Superannuation_in_Australia

Posted by: mixonkinces69.blogspot.com

0 Response to "Is There An Advantage To Adding Post Tax Money To 401k 2018"

Post a Comment